You need the right jute bags hs code when you import or export these products. This code helps you clear customs, pay correct duties, and meet legal rules. Using the wrong code can delay your shipment or cause penalties. Check the table below for the main HS codes and GST rates for jute bags as of 2025:

| Description | HSN Code | GST Rate (%) |

|---|---|---|

| Plastic Coated or Paper Cum Polythene Lined Jute Bags and Sacks | 63051060 | 18 |

| Jute Sacking Bags | 63051040 | 18 |

| Jute Hessian Bags | 63051030 | 18 |

| Jute Corn (Grains) Sacks | 63051020 | 18 |

| Paper Laminated Hessian Jute | 63051070 | 18 |

| Jute Soil Savers | 63051080 | 18 |

| Jute Bagging For Raw Cotton | 63051010 | 18 |

Key Takeaways

- It is important to use the right HS code for jute bags. This helps customs clear your goods easily. It also makes sure you pay the correct duty.

- If you use the wrong HS code, your shipment may be delayed. You could get fined or lose your goods to customs officials.

- All main types of jute bags have a GST rate of 18%. This makes it easier to figure out your costs.

- Always check HS codes on invoices and shipping papers. This helps you avoid mistakes in your paperwork.

- Ask a customs broker for help if you do not know the right HS code. This can save you from expensive errors.

- Keep up with customs rules and HS code updates. This helps you follow the law and avoid getting in trouble.

- Use a checklist to make sure all shipping papers have the right HS code.

- Look over your records often and change HS codes when your product details change.

Jute Bags HS Code Overview

Main Jute Bags HS Code Table

You must know the correct jute bags hs code before you ship or receive jute products. The right code helps you clear customs and pay the correct GST rate. The table below lists the main HS codes for jute bags and related jute products, along with GST rates as of 2025:

| Description | HS Code | GST Rate (%) |

|---|---|---|

| Jute Soil Savers | 63051080 | 18 |

| Jute Bagging For Raw Cotton | 63051010 | 18 |

| Jute Wool Sacks | 63051050 | 18 |

| Other Jute Bags | 63051090 | 18 |

| Jute Tarpaulins | 63061910 | 12 |

| Other Narrow Fabrics Of Jute | 58063930 | 5 |

| Other Carpets Of Jute | 57050032 | 12 |

| Sacking Fabrics Of Jute | 53101012 | 5 |

Tip: Always double-check the hs code for jute bags on your invoices and shipping documents. This step helps you avoid mismatched paperwork and costly delays.

HS Code for Jute Bags by Type

You will find that the hs code for jute bags changes based on the type of bag. For example, jute soil savers and jute wool sacks have their own codes. Other jute bags and jute tarpaulins also use different codes. You must select the right code for each product type to ensure smooth customs clearance.

- Jute Soil Savers: 63051080

- Jute Bagging For Raw Cotton: 63051010

- Jute Wool Sacks: 63051050

- Other Jute Bags: 63051090

- Jute Tarpaulins: 63061910

If you use the wrong hs code for jute bags, you risk shipment delays and penalties. Customs officials may fine you, seize your goods, or even take legal action. Inaccurate paperwork can lead to administrative setbacks and unhappy customers.

| Type of Penalty | Description |

|---|---|

| Fines | Vary based on culpability, from negligence to fraud. |

| Seizure of goods | Possible if misclassification is detected. |

| Legal action | May be pursued depending on the severity of the error. |

Note: Delays in customs clearance can last days or weeks. These delays can hurt your business and damage your reputation.

Jute Bags vs. Similar Products

You must not confuse jute bags with similar products like cotton or polypropylene bags. Each product uses a different HS code. This difference matters for trade and compliance.

| HS Code | Description |

|---|---|

| 630510 | Jute bags made from textile bast fibers |

| 6305.33 | Sacks and bags for packing goods, including polypropylene nonwoven shopping bags |

| 39232990 | Plastic bags (polypropylene) |

- Jute Bags: Classified under HS code 630510, used for bags made from jute or other textile bast fibers.

- Polypropylene Bags: Use HS codes 39232990 for plastic bags and 6305.33 for packing sacks.

- Cotton Bags: Have their own codes, separate from jute bags hs code.

You must use the correct hs code for jute bags to avoid confusion and penalties. This step keeps your trade process smooth and compliant.

Alert: Always check the latest customs rules for jute products. Using the wrong code can stop your shipment and cost you money.

Understanding HS Code Structure

How HS Codes Work

HS codes help people know what products are in trade. Customs officers use these codes to check what is being shipped. They also use them to set tariffs and GST rates. Each code has its own meaning. The first two numbers show the chapter. The next two numbers show the heading. The last two or four numbers show the subheading. You must pick the right code for every product you send.

If you ship jute bags, you need to know the hsn code for jute bags. This code tells customs what your item is. For example, hand bags and shopping bags made of jute have a different code than sacks or hessian bags. Here is a table with one official rule for picking HSN codes:

| HSN Code | Description | GST Rate |

|---|---|---|

| 4202 22 30 | Hand bags and shopping bags, of jute | 6% |

Using the right code helps you avoid waiting and extra fees at the border.

HSN Code of Jute Bags Explained

The hsn code for jute bags depends on what kind of bag it is. You must look at the product details and match it to the right code. Shopping bags, sacks, and soil savers all have their own codes. Customs officers want to see the correct code. If you use the wrong code, you could get a penalty.

Penalties change based on how big the mistake is:

| Level of Culpability | Penalty When No Duty Lost | Penalty When Duty Lost |

|---|---|---|

| Negligence | 5-20% of domestic value | 0.5-2 times duty loss |

| Gross Negligence | 25-40% of domestic value | 2.5-4 times duty loss |

| Fraud | 50-80% of domestic value | 5-8 times duty loss |

Customs can also hold your shipment, take your products, or stop you from importing. You must be careful when you choose the hsn code for jute bags.

Why Correct Classification Matters

Picking the right code keeps your business safe. If you use the wrong code for jute bags, you could get fined, have your shipment stopped, or get into legal trouble. In Bangladesh, the National Board of Revenue raised the fine for using the wrong HS code to Tk 100,000. This shows how serious the problem is.

Here are some risks if you use the wrong code:

- Big fines and penalties from customs.

- Your shipment could be rejected when you import or export.

- It can take a long time to get refunds for extra duties.

- You may pay more penalties if you pay too little duty, plus interest.

- Customs could take your goods and ask for more papers.

You could also lose your customs license, face criminal charges, or hurt your reputation. The table below shows more risks:

| Consequence Type | Specific Risks/Consequences |

|---|---|

| Shipment in Transit | Rejection or seizure at the border |

| Costs for storage, inspection, or failed delivery | |

| Wider Implications | Backdated duty bill for previously misclassified goods |

| Extra financial penalty on top of the backdated duty bill | |

| Loss of a customs license or AEO certification | |

| Not allowed to join government bids or tenders | |

| Criminal charges, jail, or blacklisting of company leaders | |

| Bad publicity that hurts your reputation |

Always check your code before you ship. This step saves you time, money, and problems.

Using HS Codes in Documentation

Where to Declare HS Codes

You must declare HS codes in several key documents when you import or export jute bags. Customs officers check these codes to confirm the product type and apply the correct duties. You should include the HS code on your commercial invoice, packing list, and bill of lading. You also need to enter the code in your shipping instructions and customs declaration forms. If you use digital platforms, make sure you enter the HS code in the correct field. This step helps customs process your shipment quickly.

Tip: Always double-check the HS code before submitting your documents. A small mistake can lead to shipment delays or extra fees.

Common Documentation Errors

Many importers and exporters make simple mistakes when they fill out paperwork. You might forget to include the HS code, or you might use the wrong code for your jute bags. Sometimes, people copy codes from old shipments without checking if the product matches. These errors can cause big problems.

Here are some common mistakes you should avoid:

- Leaving the HS code field blank on customs forms.

- Using an outdated or incorrect HS code for your jute bag type.

- Mixing up codes for jute bags, raw jute, and jute fabrics.

- Not updating codes when product specifications change.

- Failing to match the HS code on all documents.

If you make these mistakes, you risk shipment delays, fines from customs, or even seizure of goods. Customs officers may hold your shipment until you fix the paperwork.

| Error Type | Possible Consequence |

|---|---|

| Blank HS code field | Shipment delay |

| Wrong HS code | Fine or seizure of goods |

| Mismatched documentation | Customs inspection required |

Tips for Accurate HS Code Use

You can avoid problems by following best practices for HS code use. Accurate classification of your jute bags is the first step. You should consult with a customs broker if you feel unsure about the right code. Brokers help you calculate duties and pick the correct classification. Always include the HS code in every shipping and customs document. This habit keeps your paperwork consistent and helps customs clear your goods faster.

Here are some tips to help you:

- Check the latest customs regulations for jute bags before you ship.

- Use the official HS code list for your product type.

- Ask a customs broker for advice if you have questions.

- Update your records when product details change.

- Review all documents for matching HS codes.

Note: Raw jute (HS 5303) is usually duty-free. Jute fabrics (HS 5311) have low duties, often between 3% and 8%. Jute bags (HS 6305) have rates that depend on how the bag is made and used.

If you follow these steps, you reduce the risk of shipment delays, fines, and other problems. You also build trust with your customers and partners.

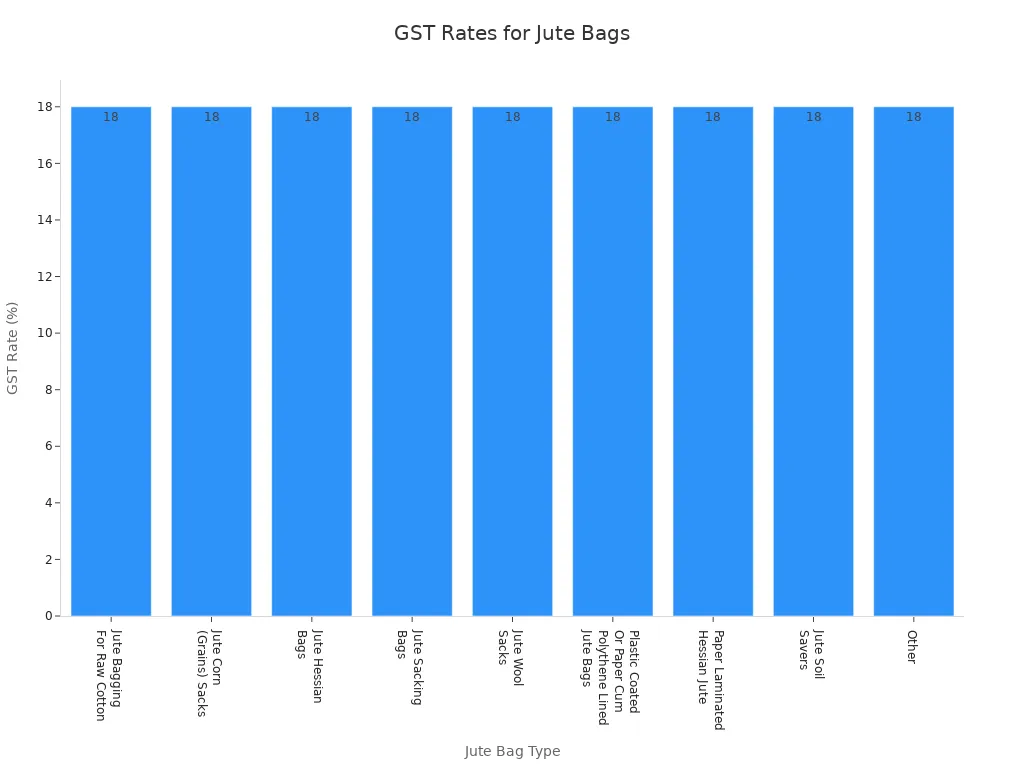

Tariff and GST Rates for Jute Bags

Understanding the tariff and GST rates for jute bags helps you plan your business costs and avoid surprises at customs. You need to know the latest rates and how they apply to each type of jute bag. This section gives you a clear overview of the current rates, effective dates, and any recent updates for 2025.

2025 Tariff Rates Table

You must check the correct tariff rates before you import jute bags. The table below lists the main HS codes for jute bags and their current GST rates. These rates have stayed the same since January 1, 2020, and continue to apply in 2025.

| HSN Code | Description | Rate (%) | Effective Date |

|---|---|---|---|

| 6305 | Sacks And Bags, Of A Kind Used For The Packing Of Goods | 18 | 01/01/2020 |

| 630510 | Of Jute Or Of Other Textile Bast Fibres Of Heading 5303 | 18 | 01/01/2020 |

| 63051010 | Jute Bagging For Raw Cotton | 18 | 01/01/2020 |

| 63051020 | Jute Corn (Grains) Sacks | 18 | 01/01/2020 |

| 63051030 | Jute Hessian Bags | 18 | 01/01/2020 |

| 63051040 | Jute Sacking Bags | 18 | 01/01/2020 |

| 63051050 | Jute Wool Sacks | 18 | 01/01/2020 |

| 63051060 | Plastic Coated Or Paper Cum Polythene Lined Jute Bags | 18 | 01/01/2020 |

| 63051070 | Paper Laminated Hessian Jute | 18 | 01/01/2020 |

| 63051080 | Jute Soil Savers | 18 | 01/01/2020 |

| 63051090 | Other | 18 | 01/01/2020 |

You see that the GST rate of jute bags remains steady at 18% for all major types. This table helps you match the right jute bags hs code with the correct rate.

GST Rates by Jute Bag Type

You need to know the gst rate of jute bags for each product type. The government sets a single GST rate for most jute bags, which makes your calculations easier. Whether you deal with jute sacking bags, hessian bags, or plastic-coated jute bags, you pay the same GST rate.

- All jute bags under HS code 6305 and its sub-codes have a GST rate of 18%.

- This rate covers jute bagging for raw cotton, jute corn sacks, hessian bags, and soil savers.

- You do not need to check for different rates for each type, which saves you time.

Tip: Always use the correct jute bags hs code on your invoices and customs forms. This step ensures you pay the right GST and avoid delays.

Recent Changes and Effective Dates

You should stay updated on any changes to the gst rate of jute bags or import tariffs. Since January 1, 2020, the GST rate for all major jute bag types has remained at 18%. No new changes have been announced for 2025. The government has kept the rates stable to support the trade of jute products and help businesses plan better.

- The last major update took effect on January 1, 2020.

- All rates in the table above remain valid for 2025.

- Customs officers will use these rates when you clear your shipments.

Note: If you see any news about changes in GST or import tariffs for jute bags, check the official government website or consult your customs broker. Staying informed helps you avoid mistakes and keeps your business running smoothly.

You can now plan your costs with confidence. Use the right jute bags hs code and stay updated on the latest rates for smooth import and export of jute products.

Compliance and Best Practices

Making Sure You Use the Right HS Code

You need to use the right HS code for every jute bag shipment. This helps your business avoid delays and fines. Customs officers look at your codes to check what you are shipping. If you pick the wrong code, you might get fined or lose your goods. Always check your product’s details with the official code list. Look for new updates before you send anything. If you are not sure, ask a customs broker or trade expert. They can help you stop expensive mistakes.

Tip: Always check your HS code before you finish your shipping papers. This habit can save you both time and money.

Checklist for Paperwork

Good paperwork keeps your shipments moving fast. Use this checklist to make sure you do everything right:

- Put the right HS code on your commercial invoice.

- Make sure the HS code matches on your packing list and bill of lading.

- Write the HS code in your customs forms.

- Check that all online forms use the same code.

- Save copies of all your documents.

- Change your codes if your product changes.

You can print this checklist and use it for every shipment. Doing your paperwork the same way each time helps you avoid border problems.

| Document Type | HS Code Required? | Notes |

|---|---|---|

| Commercial Invoice | Yes | Must match product details |

| Packing List | Yes | Use same code as invoice |

| Bill of Lading | Yes | Consistency is key |

| Customs Declaration | Yes | Enter code in correct field |

How to Avoid Common Mistakes

Many importers and exporters make easy mistakes with HS codes. These mistakes can slow down your shipment, cost you money, or even make you lose your goods. You can avoid these problems by learning what not to do:

- Thinking products that look alike have the same HS code.

- Using old codes because the rules change a lot.

- Picking a random code without checking first.

- Guessing about your product’s details.

Note: Customs officers change HS codes often. Always use the newest code to follow the rules.

If you follow these tips and stay careful, your shipments will be safe and your business will look good.

Updates and Resources

Checking for HS Code Updates

You have to keep up with new HS codes for jute bags. Customs offices change codes and rates when rules change. Always look at official government websites before you ship anything. The Central Board of Indirect Taxes and Customs (CBIC) in India and the World Customs Organization (WCO) share the newest updates. These places help you follow trade rules and avoid errors.

Set reminders to check for updates every few months. Many exporters get email alerts from customs sites. You should also talk to your customs broker about any new changes. Brokers often learn about updates before everyone else. If you send big shipments, always check for new GST rates and tariff codes. This habit keeps your paperwork right and your shipments on time.

Tip: Always match your HS code list with the newest government news. This step helps you stop fines and delays.

Useful Trade Resources

You can find good information about HS codes and GST rates from trusted sources. These places help you check codes and rates for jute bags. Use official websites and guides to make sure your data is right. Here is a table with some top resources for jute bag codes and rates:

| Description | HSN Code | GST Rate |

|---|---|---|

| Jute bags | 63051010 | 5% |

| Cordage, Cable, Rope and Twine of Jute | 56071010 | 12% |

| Sacks and bags for packing goods | 6305 | 5% |

You can use these codes when you fill out shipping papers. The CBIC website shows all the latest codes and rates. The WCO gives world rules for product codes. You should also look at the Directorate General of Foreign Trade (DGFT) for export rules. These resources help you follow trade laws and keep your business safe.

- CBIC Portal: Latest HS codes and GST rates for India.

- WCO Database: World rules for product codes.

- DGFT Notifications: Export rules and updates.

- Customs Broker Networks: Early news and expert help.

Note: You should save these resources and check them before each shipment. This habit helps you follow the rules and avoid mistakes.

You can earn trust from your customers by using the right codes. Good resources make your trade work easy and professional.

Conclusion

You must use the right HS code for jute bags. This helps you follow the rules and avoid big mistakes. Make sure you know the latest tariff and GST rates. This will help you ship jute bags easily to other countries.

Here is a simple checklist to help you stay on track:

- Make sure the HS code is correct for each product.

- Look over all your shipping and customs papers.

- Watch for new GST rates and trade rule changes.

- Keep good records and save proof of what you do.

Do you want jute bags made just for you or in large amounts? Need OEM or ODM services? Reach out to us for help and expert advice.

FAQ

What is the HS code for jute bags?

You use HS code 630510 for most jute bags. Specific types, such as jute soil savers or hessian bags, have unique sub-codes. Always check your product details before choosing the code.

Do all jute bags have the same GST rate?

Yes. You pay 18% GST on most jute bags under HS code 6305 and its sub-codes. This rate applies to sacking bags, hessian bags, and plastic-coated jute bags.

Where do I declare the HS code for jute bags?

You must declare the HS code on your commercial invoice, packing list, bill of lading, and customs declaration forms. This step helps customs officers process your shipment quickly.

What happens if I use the wrong HS code?

You risk shipment delays, fines, or even seizure of goods. Customs officers may also require extra paperwork or reject your shipment. Always double-check your codes.

How can I find the latest HS code updates?

Visit the CBIC website or the World Customs Organization portal. You can also ask your customs broker for recent updates. Set reminders to check for changes before each shipment.

Are jute bags and polypropylene bags classified under the same HS code?

No. Jute bags use HS code 630510. Polypropylene bags use different codes, such as 39232990 or 630533. Always classify your products correctly to avoid penalties.

Can I get help with HS code classification?

Yes. You can consult a licensed customs broker or trade expert. They help you choose the correct code and avoid costly mistakes.