You should know the laundry bag hs code before you import or export. Customs officers use this code to find out what your goods are. If you choose the wrong code, you might face delays. You could also get fines or pay extra fees. Using the right code helps your goods clear faster. It also helps calculate duties correctly. Picking the right code saves you time and money.

Key Takeaways

- Use the right HS code for laundry bags. This helps you avoid customs problems and fines.

- HS codes sort products worldwide. They help customs know the right taxes and rules.

- Laundry bags made from different materials need special HS codes. Always check what material your bag is before you ship it.

- Picking the correct HS code for laundry bags stops expensive errors. It also helps your bags get through customs easily.

- Talk to customs brokers if you need help with HS codes and rules. They can give you good advice.

- Keep good records of all your shipping papers. This helps you avoid trouble and delays.

- Check your HS code and papers again before you ship. This saves you time and money.

- Learn about your country’s customs rules. HS codes can be different in each country.

Laundry Bag HS Code Overview

What Is an HS Code

You should know what an HS code is before you ship laundry bags.

The Harmonized Commodity Description and Coding System, called the ‘Harmonized System’ or ‘HS’, is a worldwide product naming system made by the World Customs Organization (WCO).

HS codes have six numbers. Every country using the Harmonized System follows this rule. The first six numbers show the product group everywhere. Some countries add more numbers for extra details. These codes help customs officers see what you are sending.

Why HS Codes Matter

HS codes are very important in global trade. You must use the right code for your laundry bags. This helps you follow trade laws and lets your shipment pass customs fast.

HS codes for laundry bags, like 630790, put them in “Other made-up textile articles.” This helps customs officers set duties and check if your items meet shipping rules.

If you pick the wrong code, you can have trouble:

- Customs might stop or hold your shipment. You may pay more for storage.

- You could get fines. These can be twice the lost duties or up to $5,000 for ISF mistakes.

- A company once used the wrong HS code for clothes. Customs held their shipment and checked it carefully. This cost them more money and time.

HS codes help you:

- Make customs go smoothly

- Get correct duty charges

- Follow shipping laws

- Keep your products safe while moving

- Make importing and exporting easier

Laundry Bag HS Code by Material

Laundry bags are made from different things. You need to pick the right HS code for your bag’s material. The table below shows common HS codes for laundry bags by what they are made of:

| Material Type | HS Code |

|---|---|

| Of jute or other textile bast fibres | 63051000 |

| Of cotton | 63052000 |

| Flexible intermediate bulk containers | 63053200 |

| Other, of polyethylene or polypropylene | 63053300 |

| Other | 63053900 |

| Of other textile materials | 63059000 |

Textile and Fabric Bags

If your laundry bags use cotton, jute, or other textiles, use codes like 63051000 for jute or 63052000 for cotton. These codes tell customs officers your bags are made from natural fibers.

Mesh Laundry Bags

Mesh laundry bags often use man-made fibers. You may need 63053300 for bags made of polyethylene or polypropylene. If your mesh bag uses other textiles, 63059000 is the right code.

Plastic and Synthetic Bags

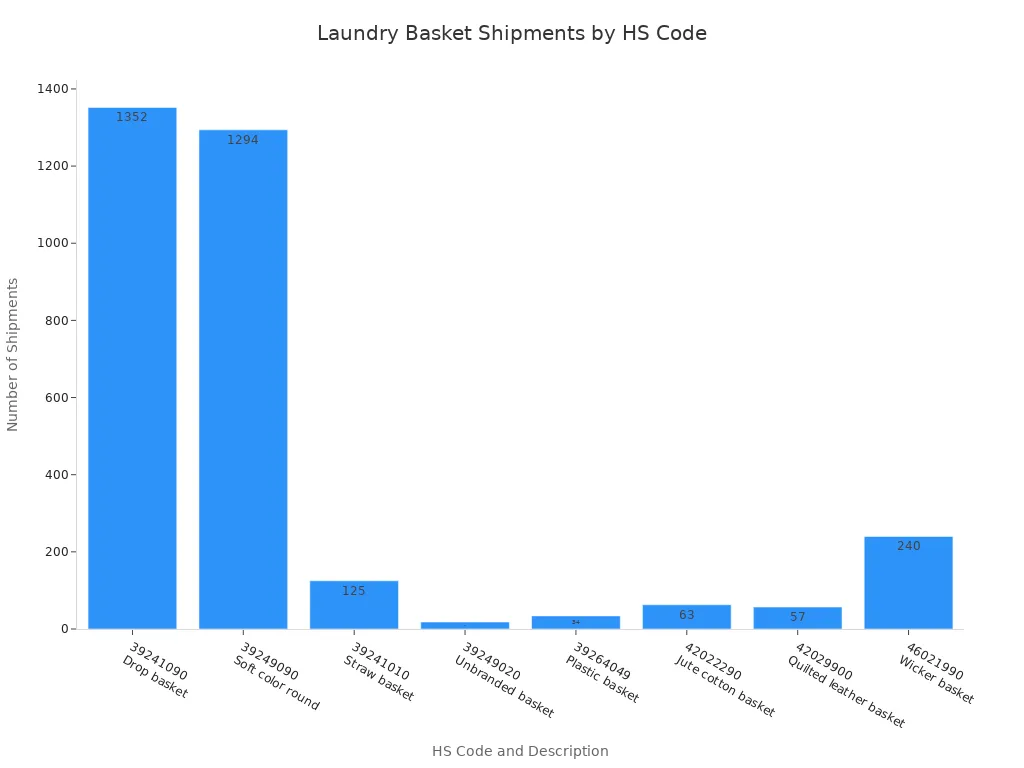

Plastic laundry bags have special codes. Here are some examples in the table below:

| HSN Code | HSN Description | Used in No. of Shipments |

|---|---|---|

| 39241090 | Drop laundry basket | 1352 |

| 39249090 | Soft laundry basket color round type | 1294 |

| 39241010 | Straw laundry basket | 125 |

| 39249020 | Laundry basket (unbranded) | 18 |

| 39264049 | Laundry basket plastic | 34 |

Other Materials

Some laundry bags use leather, wicker, or mixed materials. For example, quilted leather bags use 42029900. Wicker baskets use 46021990. If your bag has jute and cotton, you can use 42022290.

Tip: Always look at the material and how your laundry bag is made before you pick the HS code. This helps you avoid mistakes and delays.

Note:

HS codes can be different in each country. Some places add more numbers for extra details. You should always check local rules and ask your customs broker or local office about the laundry bag hs code. This helps you avoid expensive errors and makes sure your shipment passes customs without trouble.

Classification Process

Key Classification Factors

When you need to classify a laundry bag for customs, you should look at three main things. Each thing helps you pick the right code and keeps you out of trouble at the border.

Material Type

First, check what your laundry bag is made from. Is it cotton, polyester, plastic, or another material? Customs officers use the material to put your product in the right group. For example, a cotton bag gets a different code than a plastic bag.

Intended Use

You also need to think about how people use the laundry bag. If the bag is for home laundry, it might get a different code than a bag for industrial laundry. The way people use the bag can change the code and affect taxes and import fees. If you pick the wrong code, you could lose export benefits or get in trouble with customs. Always match the code to how your product is really used.

Product Features

Check the features of your laundry bag. Does it have handles, zippers, or mesh panels? These features can put your product in a different group. You should describe your bag clearly on all papers.

How to Classify Laundry Bags

Follow these steps to classify your laundry bag the right way:

- Identify the Material: Find out if your bag is textile, plastic, or something else.

- Determine the Intended Use: Decide if the bag is for home, business, or factory use.

- Review Product Features: Write down any special features like drawstrings, mesh, or strong seams.

- Consult the HS Code List: Look at the official HS code book to find the best match.

- Check Local Regulations: Some countries add extra numbers or rules. Always ask your customs broker or local office.

- Document Everything: Write clear details on invoices and shipping papers.

Accurate classification helps you avoid delays, fines, and extra costs. It also makes sure you pay the right duties and follow all trade laws.

Common Mistakes

Many importers make mistakes when they classify laundry bags. These mistakes can cause big problems. The table below shows the most common mistakes and why you should not make them:

| Mistake Type | Description |

|---|---|

| Relying on Brokers | Do not let brokers pick codes without you checking. This can cause wrong codes. |

| Using Rulings Incorrectly | Always check if customs rulings are new and fit your case. Old rulings can give you the wrong code. |

| Classifying by Default | Never pick a code just because it has a low duty. This often gives you the wrong code. |

| Assuming Technical Experts | Knowing about products is not enough. You need someone who knows how to classify. |

| Misleading Descriptions | Do not use product descriptions that do not match the real item. Wrong words can give you the wrong code. |

If you pick the wrong laundry bag hs code, you can face serious problems. These can be customs delays, fines, legal trouble, and even losing your right to import or export. Sometimes, picking the wrong code on purpose can lead to criminal charges.

| Consequence | Description |

|---|---|

| Legal implications | Customs may hold your shipment, fine you, or take legal action. |

| Financial repercussions | Fines and penalties can hurt your business money. |

| Reputational damage | Mistakes can hurt your reputation and cost you customers. |

| Loss of import/export privileges | You could lose the right to import or export. |

| Criminal charges | Fraud charges may send executives to jail. |

Tip: Always check your laundry bag hs code before you ship. This step keeps your business safe and helps your shipments move fast.

Tariffs and Duties

Impact of HS Codes on Tariffs

When you import laundry bags, the HS code you choose directly affects the tariff rate. Customs officers use this code to decide how much duty you must pay. If you select the correct code, you avoid paying too much or too little. You also prevent delays at the border. The laundry bag hs code helps you get the right tariff and keeps your shipment moving.

Tip: Always double-check your HS code before you ship. This step saves you money and time.

Country-Specific Duty Rates

United States

You pay duties based on the Harmonized Tariff Schedule (HTS). Most laundry bags fall under a duty rate between 2.5% and 6%. If your shipment arrives by sea, you pay a Harbor Maintenance Fee of 0.125% of the cargo value. You also pay a Merchandise Processing Fee, which depends on the shipment value and is capped at $651.50. If your bags come from a country without a Free Trade Agreement, you may pay a baseline tariff of 10%. Some shipments face a reciprocal tariff of 19% if there is a trade imbalance.

European Union

In the EU, you pay duties based on the Combined Nomenclature (CN) code. Most textile laundry bags have a duty rate between 3% and 9%. If you import from a country with a trade agreement, you may pay less. The EU also charges a Value Added Tax (VAT) on most imports. You must pay VAT at the rate set by each country, usually between 19% and 21%.

Other Major Markets

Other countries set their own duty rates. In Canada, you pay between 8% and 12% for most laundry bags. Australia charges between 5% and 10%. Some countries add surcharges or excise taxes for certain materials. Always check the local tariff schedule before you ship.

Additional Taxes and Fees

You must pay more than just basic duties when you import laundry bags. The table below shows common taxes and fees in major markets:

| Tax/Fee Type | Description |

|---|---|

| Harmonized Tariff Schedule (HTS) | Primary duty imposed on all imports, rates vary by product classification, typically 2.5% to 6%. |

| Merchandise Processing Fee (MPF) | Charge applied to most imports, varies based on shipment value, capped at USD 651.50. |

| Harbor Maintenance Fee (HMF) | 0.125% fee on cargo value for goods arriving by sea, not applicable for air shipments. |

| Baseline Tariff | 10% surcharge on imports from non-FTA countries, applied on top of HTS duty. |

| Reciprocal Tariff | Country-specific surcharge targeting imports from countries with trade imbalances, currently 19%. |

| Excise Tax | Federal tax on specific regulated goods, collected in addition to standard import tariffs. |

Note: You must check all taxes and fees before you import. These costs change often. If you miss a fee, customs may hold your shipment.

You can avoid surprises by working with a customs broker. Brokers help you find the right rates and fees. They also help you prepare your paperwork. This step keeps your costs low and your shipments on time.

Customs Clearance Steps

Required Documentation

You need to get some papers ready before shipping laundry bags. Customs officers use these papers to check your shipment. They also use them to let your goods enter the country. If you forget a paper, your laundry bags might get delayed.

Invoice and Packing List

You must have a commercial invoice and a packing list. The invoice shows the price, what the bags are, and how many you have. The packing list tells how you packed your laundry bags. Customs officers use these papers to match your shipment with your declaration.

Bill of Lading/Airway Bill

You need a bill of lading for sea shipments. For air shipments, you need an airway bill. These papers prove you shipped your laundry bags. They also show who owns the bags while they travel. Customs uses these to track your laundry bags from the seller to the buyer.

Certificate of Origin

Customs needs a certificate of origin to know where your laundry bags were made. This paper can help you pay less duty if your country has a trade deal. You might need different certificates for your shipment:

| Document Type | Description |

|---|---|

| Proof of origin | A trade paper that shows where your laundry bags come from. |

| Certificates of non-preferential origin | Shows your bags do not get special treatment, given by chambers of commerce. |

| Certificates of preferential origin | Lets your bags get lower duties, given by customs in the exporting country. |

| Invoice declarations | Given by exporters, with rules based on the shipment’s value. |

Compliance Requirements

You must follow strict rules for labels and safety when importing laundry bags. Customs officers check these rules to keep buyers safe and make trade fair.

Labeling and Marking

Your laundry bags need clear labels. You must show what fibers are in the bag, where it was made, and who made it. You also need care instructions. The importer must make sure all labels follow the rules. If you do not follow the rules, customs may delay or stop your shipment.

| Requirement | Description |

|---|---|

| Fiber Content | Must show what fibers are in the laundry bag. |

| Country of Origin | Must say where the laundry bag was made, following CBP rules. |

| Manufacturer Identification | Needs the name or RN number of the maker or importer. |

| Care Instructions | Must give care instructions for the laundry bag. |

| Compliance Responsibility | The importer must follow FTC labeling rules. |

| Consequences of Non-Compliance | Not following rules can mean delays, entry refusal, or FTC actions. |

Safety Standards

You must meet safety rules for textile products. Laundry bags need labels with fiber details and may need lab tests. You must keep records and invoices for every shipment. Some laundry bags need extra papers for ads and safety.

| Requirement | Description |

|---|---|

| Fiber Composition | Textile laundry bags must have a label with fiber details. |

| Advertisements | Ads must follow rules for showing fiber content. |

| Documentation | You must keep records, invoices, and sometimes extra papers. |

| Lab Testing | Some laundry bags need lab tests to meet safety rules. |

Tip: Always check the newest customs rules before you ship. This helps you avoid delays and fines.

Smooth Clearance Tips

You can make customs go faster by doing these things:

- Check all your papers before you ship.

- Use simple and correct product descriptions.

- Work with a licensed customs broker for help.

- Keep records of every shipment and check for rule-following.

- Label each laundry bag the right way for your country.

If you get your papers ready and follow the rules, you lower the chance of delays. You also keep your business safe from fines and legal problems. Customs officers clear shipments faster when you meet all the rules.

Practical Import & Export Steps

Verifying Laundry Bag HS Code

You must check the laundry bag hs code before shipping. This step helps you avoid big mistakes and keeps your shipment moving. Start by seeing which HS codes other importers use for laundry bags. Look up these codes and compare your product’s material, size, and use to customs rules. Rules can change in each country, so always ask your broker or customs office for updates.

Look at recent shipments to see which codes worked for similar items. Keep records of your HS code choices for later. If you use the wrong code, you might lose export benefits or pay more duties. Careful checking protects your business and helps you follow the rules.

Tip: Always check product details and match them to customs rules. This habit helps you avoid mistakes and delays.

Checklist for HS Code Verification:

- Check codes used by other importers

- Look up official customs rules

- Ask your broker or customs office

- Review codes from past shipments

- Keep records of your choices

Working with Brokers

Customs brokers help you with import rules and paperwork. You should learn customs steps and tariffs because the right HS code affects your duties. Give a Power of Attorney (POA) to your broker. This paper lets them act for you during customs clearance. Get all needed papers ready, like invoices and packing lists. Your broker will guide you and check for mistakes.

Brokers use their skills to stop costly delays. They know which papers you need and how to fill them out. You can trust their advice to keep your shipment moving.

Steps for Working with Brokers:

- Learn customs steps and tariffs for laundry bags.

- Give a POA to your broker.

- Get and send all needed papers.

- Use your broker’s skills to avoid errors.

Note: A good broker saves you time and money. They make sure your shipment meets all customs rules.

Avoiding Delays and Penalties

Delays and penalties can hurt your business. You must avoid common mistakes to keep your shipment moving. Wrong invoices, missing or messy papers, and saying goods are worth less often cause problems. Missing licenses or permits and problems with the consignee also slow things down.

Bad product descriptions and wrong papers can bring penalties. Missing info about the consignee or shipper, and wrong value or amount of goods, are common causes of trouble.

Common Causes of Delays and Penalties:

- Wrong commercial invoice

- Missing papers

- Saying goods are worth less

- Missing licenses or permits

- Consignee problems

- Bad product descriptions

- Wrong value or amount

Alert: Always check your papers and product details twice. Correct info helps you avoid fines and keeps your shipment on time.

Table: How to Prevent Delays and Penalties

| Problem | Prevention Tip |

|---|---|

| Wrong invoice | Check all values and details |

| Missing papers | Use a checklist for every form |

| Saying goods are worth less | Say the true value of goods |

| Missing permits | Check all needed licenses |

| Consignee problems | Make sure contact details are right |

You can stop most problems by staying organized and working with your broker. Careful planning and paying attention to details keep your laundry bag shipments safe and on time.

Recordkeeping

You need to keep good records when you import or export laundry bags. Customs officers can ask for your papers at any time. If you do not have the right documents, you might get delays or fines. You could even lose your right to import. Good recordkeeping helps you show you followed all the rules.

Keep every paper about your shipment. These records show what you sent and who sent it. They also show how your laundry bags moved from place to place. You must keep proof that you paid the right duties and followed trade deals.

Here is a table with the main records you need for laundry bag imports:

| Record Type | Description |

|---|---|

| Evidence of right to make entry | Airway bill, bill of lading, or carrier certificate when goods arrive by common carrier |

| Declaration of entry | Usually found on the entry summary or warehouse entry |

| Power of attorney | Needed if you let someone else, like a broker, act for you |

| Packing list | Lists what is in each box or package |

| Bond information | Shows you have a bond for your shipment, unless you meet an exception |

| Vessel, Vehicle, or Air Manifest | Filed by the carrier to show how goods entered the country |

| Entry Number | Required on Customs Form 3461 or its electronic version |

| Documentation for preferential tariff treatment | Needed if you use trade deals like USMCA or PANTPA |

Tip: Keep all your records for at least five years. This is the rule in many countries, like the United States.

Organize your records by each shipment. Use folders or digital files with clear names and dates. Always back up your files so you do not lose them. If you use a customs broker, ask for copies of all your papers.

Here are some best ways to keep records:

- Save both paper and digital copies of every document.

- Check your records after each shipment for missing papers.

- Teach your team to save every import and export document.

- Set reminders to review and update your files every year.

If you keep good records, you can answer customs questions quickly. You also protect your business from fines and legal trouble. Good recordkeeping makes importing and exporting easier and safer.

Troubleshooting & Resources

Handling Classification Issues

You might have trouble picking the right HS code. Sometimes, your laundry bag’s material or use does not fit one code. You may feel confused about which code to pick. If you pick the wrong code, customs can slow down your shipment or charge you more.

To fix these problems, look at your product details first. Check what your laundry bag is made of, its size, and its features. Match these details with the official HS code list. If you are still not sure, ask your customs broker for help. You can also get a binding ruling from customs. This ruling gives you an official answer for your product’s code. Keep all your records and choices in case you need to show proof later.

Tip: Always check your classification twice before you ship. This step helps you avoid expensive mistakes.

Appealing Customs Decisions

Sometimes, customs officers do not agree with your HS code choice. They might change your code or charge you more duties. If this happens, you can appeal their decision.

Start by reading the customs notice. It will tell you why they changed your code. Gather all your papers, like invoices, product photos, and old rulings. Write a simple letter to customs. Say why your code is right. Attach your proof. You may need to go to a hearing or send more info. Customs will look at your case and give you a final answer.

If you still do not agree, you can take your case to a higher authority or court.

Online Tools and Resources

You can use many online tools to help with HS code lookup and rules. These tools make your work easier and help you avoid mistakes.

HS Code Lookup

- FindHS: This tool helps you find the HS code for textile fabric drawstring laundry bags. You can search by product name or description.

- Image-Based Classification: Some websites let you upload a photo of your laundry bag. The tool suggests the best HS code from the image.

- Tariff Classification Service: This service gives expert help to find the right HS code for your product.

Official Customs Sites

- US Customs Ruling (CROSS): You can search for official rulings about laundry bags. These rulings show how customs classified similar products.

- Customs Duty Rates: Official customs websites let you check duty rates for laundry bags in the USA, EU, and other countries.

Industry Associations

- Many industry groups share guides and news about HS codes for laundry bags. They give best practices and answer common questions.

- You can join these groups to get updates, training, and help for your import and export needs.

Note: Use these tools and resources to stay updated. They help you classify your laundry bags the right way and avoid customs problems.

Our Laundry Bag Manufacturing & Custom Services

Why Choose Us

You want a laundry bag supplier who understands your needs. You expect quality, reliability, and fast service. Our company delivers all three. We have years of experience in manufacturing laundry bags for global clients. You get products that meet strict standards and pass all customs checks.

- You receive laundry bags made from premium materials.

- You benefit from advanced production technology.

- You enjoy consistent quality control at every step.

- You work with a team that responds quickly to your questions.

Tip: Choose a manufacturer who knows international trade rules. This helps you avoid customs delays and extra costs.

Here is what sets us apart:

| Feature | Your Benefit |

|---|---|

| Fast lead times | You get your order on time |

| Custom design support | You create bags that fit your brand |

| Global shipping | You receive products anywhere |

| Compliance expertise | You avoid import problems |

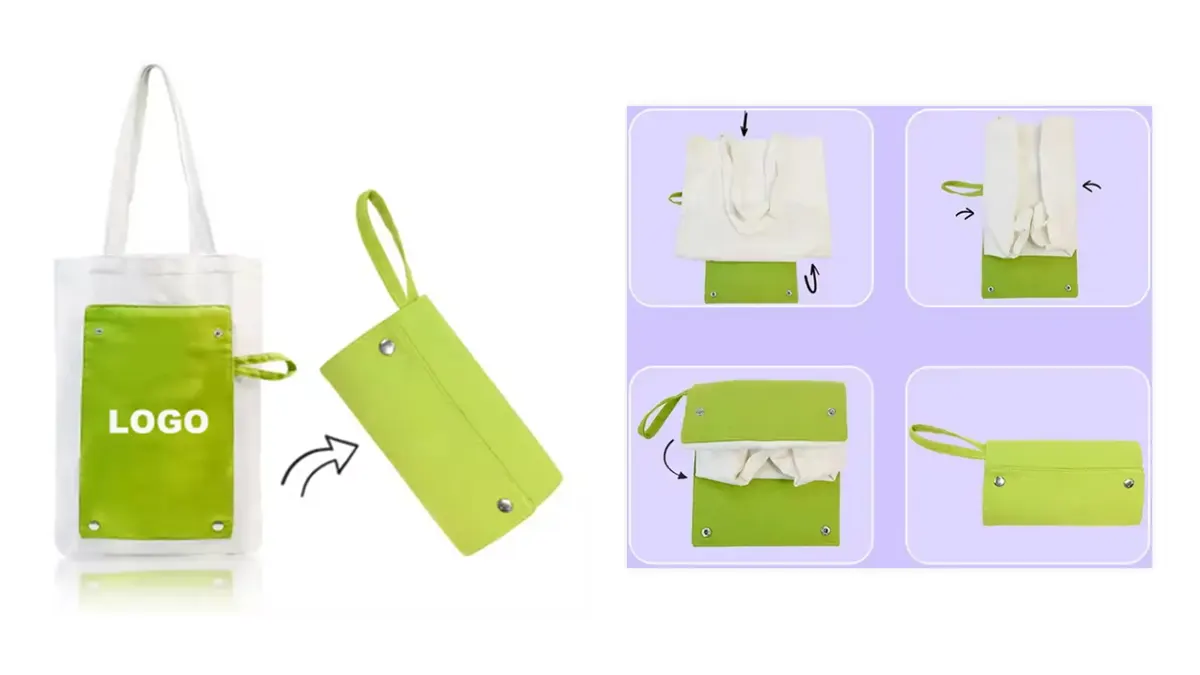

OEM & ODM Options

You can customize your laundry bags with our OEM and ODM services. OEM means you use your own brand and design. ODM means you pick from our ready-made designs and add your logo. You choose the style, size, color, and material. We help you create laundry bags that match your market.

- You select from a wide range of fabrics and finishes.

- You add features like drawstrings, zippers, or mesh panels.

- You request special packaging or labeling for retail or wholesale.

Note: Our design team guides you through every step. You see samples before we start full production.

OEM & ODM Process:

- You share your ideas or requirements.

- We create samples for your review.

- You approve the design and details.

- We start mass production and quality checks.

- You receive your shipment with all documents ready for customs.

Contact for Wholesale

You want to place a bulk order or discuss custom options. You can reach our sales team by email, phone, or our website contact form. We answer all questions within one business day. You get a clear quote and production timeline.

Alert: Ask for a free sample or a custom quote. You get expert advice on HS codes and shipping.

You grow your business with a trusted laundry bag supplier. You avoid risks and delays. You get support from start to finish.

Conclusion

Choosing the right laundry bag HS code keeps your shipments compliant and saves you money. You avoid delays and penalties when you follow this guide. As your trusted laundry bag manufacturer, we help you meet every import rule. You can use our OEM and ODM services for custom solutions.

Ready to grow your business? Contact us today for wholesale orders or custom requests. Let’s build a strong partnership together!

FAQ

What is the HS code for a cotton laundry bag?

You use HS code 63052000 for cotton laundry bags. Customs officers recognize this code for products made from cotton fabric. Always check your product material before you choose the code.

How do you find the correct HS code for your laundry bag?

You review your bag’s material, features, and use. You search official customs databases or ask your broker. You compare your product to similar items in recent shipments.

Do HS codes change in different countries?

Yes, countries may add extra digits or rules. You must check local customs regulations before you ship. Your broker can help you confirm the correct code for each country.

What documents do you need for laundry bag import?

You prepare a commercial invoice, packing list, bill of lading or airway bill, and certificate of origin. You keep all records for at least five years.

Can you appeal if customs changes your HS code?

You can appeal by sending a letter with proof, such as invoices and product photos. Customs reviews your case and gives a final decision. You may need to attend a hearing.

What happens if you use the wrong HS code?

You risk shipment delays, fines, or legal trouble. Customs may hold your goods or refuse entry. You protect your business by checking codes before you ship.

How do you label laundry bags for import?

You include fiber content, country of origin, manufacturer name, and care instructions. You follow local labeling rules to avoid customs delays.

Who can help you with HS code classification?

You work with a licensed customs broker. You use online tools and official customs websites. You join industry associations for guidance and updates.